Benzix News Hub

Stay updated with the latest news, trends, and insights.

Marketplace Liquidity Models: The Hidden Mechanics That Keep Buyers and Sellers Dancing

Discover the secret mechanics of marketplace liquidity models and how they keep buyers and sellers in sync. Unlock insider insights now!

Understanding Marketplace Liquidity: Key Concepts and Mechanics

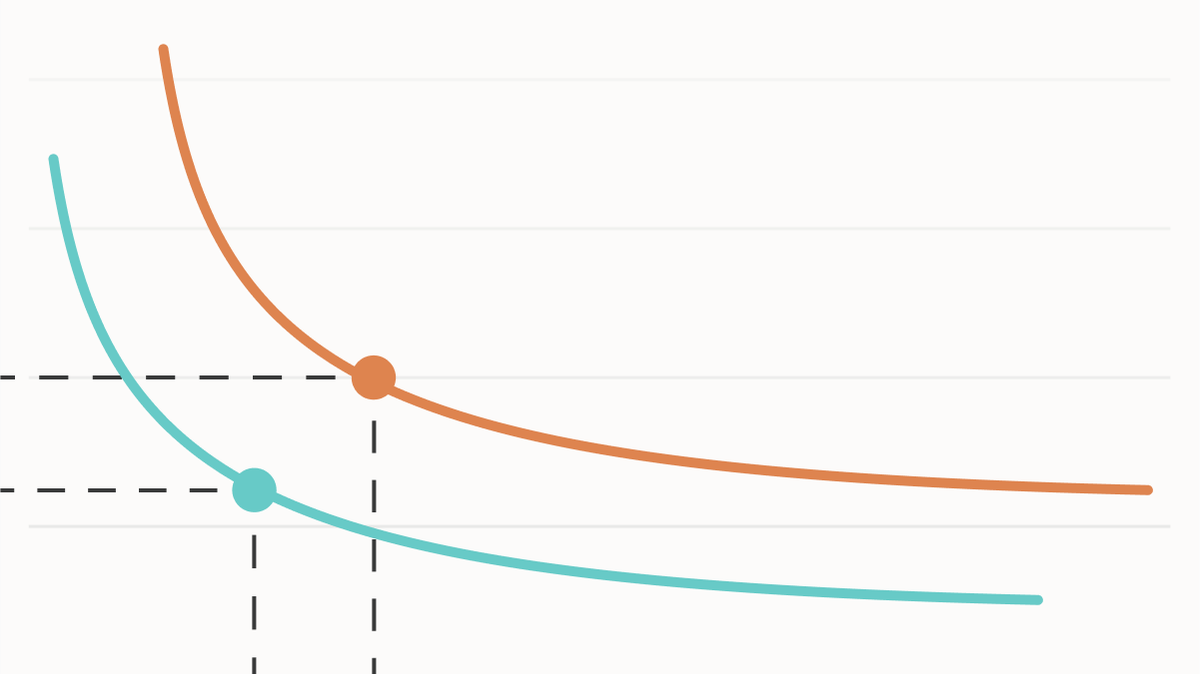

Marketplace liquidity is a vital concept that represents the ease with which assets can be bought or sold in a given market without causing a significant impact on the asset's price. In simpler terms, liquidity refers to how quickly and efficiently a market can facilitate the buying and selling of goods. High liquidity ensures that transactions can occur rapidly and with little price fluctuation, which is beneficial for both buyers and sellers. Conversely, low liquidity can lead to delays and larger price changes, often resulting in unfavorable conditions for market participants.

Understanding the mechanics of marketplace liquidity involves several key factors, including supply and demand, market participants, and transaction costs. The balance between supply and demand determines how easily buyers can find sellers and vice versa. Additionally, the presence of various market participants, from individuals to institutional investors, contributes to overall liquidity. An effective marketplace should also minimize transaction costs, as high costs can deter trading activity. In summary, marketplace liquidity is shaped by the interplay of these factors, affecting overall market efficiency and participant experience.

Counter-Strike is a popular first-person shooter game that emphasizes teamwork and strategy. Players engage in various game modes, and a key aspect of its appeal is the ability to customize weapons. For those looking to enhance their gaming experience, be sure to check out the latest daddyskins promo code for exclusive in-game items.

How Do Liquidity Models Impact Buyer and Seller Behavior?

Liquidity models play a crucial role in shaping the behavior of both buyers and sellers in various markets. These models define how easily assets can be bought and sold without causing significant price fluctuations. For instance, in a high liquidity environment, buyers are more confident in making purchases, as they know they can resell their assets quickly if needed. Conversely, sellers are encouraged to list their assets when they believe there is sufficient demand, leading to quicker transaction times and a more dynamic marketplace. As a result, understanding liquidity models can help market participants make informed decisions that align with their financial goals.

On the flip side, when liquidity is low, buyer and seller behavior can drastically change. Buyers may become hesitant to make commitments, fearing that they will not be able to liquidate their assets easily. This can lead to a decrease in demand, subsequently causing price volatility. Sellers may also refrain from entering the market during periods of low liquidity, as they might struggle to find buyers who are willing to pay their desired prices. Therefore, liquidity models not only influence transaction frequencies but also serve as a barometer for overall market health, impacting strategies adopted by both buyers and sellers.

The Dynamics of Marketplace Liquidity: What Every Participant Should Know

The dynamics of marketplace liquidity play a crucial role in determining the efficiency and functionality of financial markets. Liquidity refers to how quickly and easily assets can be bought or sold without significantly affecting their price. Understanding the various types of liquidity—such as market liquidity and fundamental liquidity—is essential for every participant, whether they are traders, investors, or analysts. Market liquidity is influenced by factors like the volume of trades, the number of participants, and the structure of the market. In contrast, fundamental liquidity is tied to the underlying policies and economic conditions that govern the marketplace.

For participants to effectively navigate through liquidity dynamics, it's vital to keep an eye on several key indicators. For instance, bid-ask spreads can provide insights into how much liquidity exists at any given moment. Moreover, analyzing trading volumes and order book depth can further aid participants in identifying potential liquidity risks. By being aware of these elements, participants can make informed decisions that enhance their trading strategies and risk management practices. Remember, in the realm of marketplace liquidity, knowledge is power, and being informed can significantly improve your advantage in the marketplace.